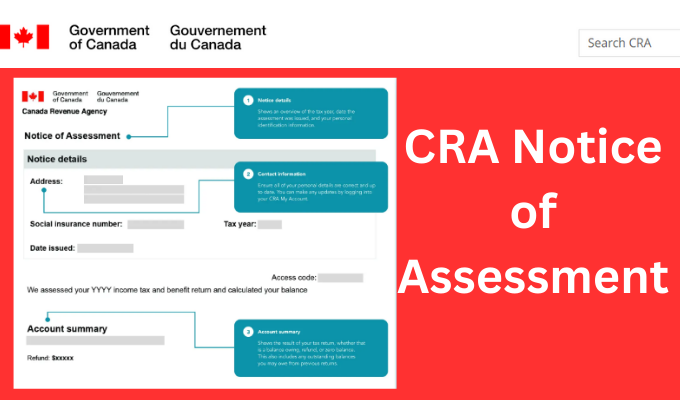

The Notice of Assessment (NOA) is a crucial document issued by tax authorities to individuals after they have filed their income tax returns. It serves as an official summary of the taxpayer’s income, deductions, credits, and any taxes owed or refunds due for a specific tax year. This document holds significant importance for various purposes, including financial planning, loan applications, proof of income verification, tax compliance, and more.

Key Features:

- Comprehensive Tax Summary: The NOA provides a detailed breakdown of the taxpayer’s income sources, allowable deductions, tax credits claimed, and the resulting tax assessment for the specified tax year.

- Official Documentation: Issued by the tax authority, the NOA carries significant credibility and authenticity, making it widely accepted as proof of income and tax compliance by financial institutions, government agencies, employers, and other relevant parties.

- Income Verification: As a summary of income assessed by the tax authorities, the NOA serves as tangible evidence of an individual’s financial standing, facilitating various processes such as loan applications, rental agreements, and immigration procedures.

- Tax Compliance Confirmation: Receipt of the NOA confirms that the taxpayer has fulfilled their obligation to file income tax returns for the specified tax year and provides clarity on any outstanding taxes owed or refunds due.

- Financial Planning Tool: The information provided in the NOA can be invaluable for individuals and financial advisors in assessing tax liabilities, planning for future tax obligations, and optimizing financial strategies.

How It Works:

- Tax Filing: Taxpayers submit their income tax returns to the relevant tax authority by the specified deadline, either through electronic filing or by mail.

- Processing: The tax authority processes the tax returns, verifies the information provided, and assesses the taxpayer’s income, deductions, credits, and taxes owed or refunds due.

- NOA Issuance: Upon completion of the assessment process, the tax authority issues the Notice of Assessment to the taxpayer, typically through electronic means or by mail to the address provided on the tax return.

- Review and Action: Taxpayers should carefully review their NOA to ensure accuracy and address any discrepancies or concerns with the tax authority promptly. Depending on the contents of the NOA, taxpayers may need to take action, such as making payments for taxes owed or claiming refunds.

Benefits:

- Credibility and Authenticity: The NOA is an official document issued by the tax authority, providing assurance of its credibility and authenticity when presented to third parties for income verification or tax compliance purposes.

- Clarity and Transparency: By summarizing the taxpayer’s income, deductions, credits, and tax assessment, the NOA offers clarity and transparency regarding their financial status and tax obligations for the specified tax year.

- Facilitates Financial Transactions: The NOA serves as a vital document for various financial transactions, including loan applications, rental agreements, and immigration processes, streamlining the verification process for individuals and institutions alike.

Reviews

There are no reviews yet.